When you advertise on the web, there’s not much you can instantly discern about your audience. With WURFL device intelligence, you can now pinpoint the price of the smartphone model your mobile viewers are using.

How Mobile Marketing Tech Leaders Get Ahead

Sophisticated brands and mobile advertisers can correlate the smartphone model to other demographic and technographic segmentation criteria, leading to better targeting and improved ROI. But what if you could instantly also know the price of their smartphone. For advertisers, using smartphone price as an indicator of willingness to pay is, well… priceless!

We continue to add innovative new capabilities to WURFL’s device detection intelligence. Recently, we added each model’s Manufacturer’s Suggested Retail Price (MSRP) at the initial date of release. In the MOVR 2016 Q3 report, we applied this MSRP to billions of records and discovered some interesting trends.

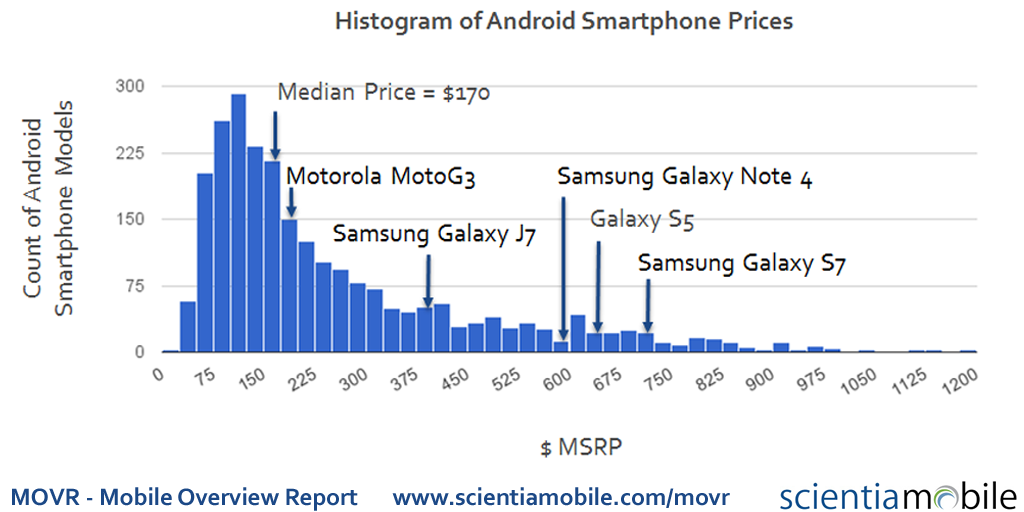

83% of Android Smartphones Models Have Price Under $400

We found 2,464 Android models, ranging in price from under $100 to more than $1,100. More than 2,000 of the Android devices are less than $400. However, many of the world’s most popular phones have an MSRP of more than $600, including Samsung’s Note 4, S5, and S7. This indicates that a well-designed phone, with innovative features, and a trusted brand is able to command a premium price.

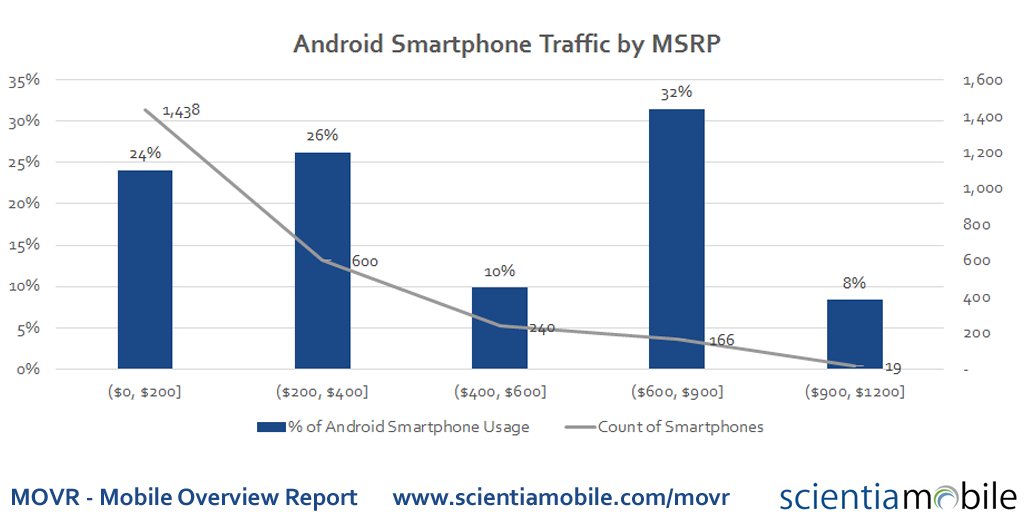

Premium-Price Smartphone Models Generate 32% of Traffic

Looking at Android smartphone usage, 50% of traffic comes from 2,038 low-priced models with a MSRP under $400.

A relatively small set of 166 premium-priced phones with MSRP between $600 and $900 are very popular, generating 32% of traffic.

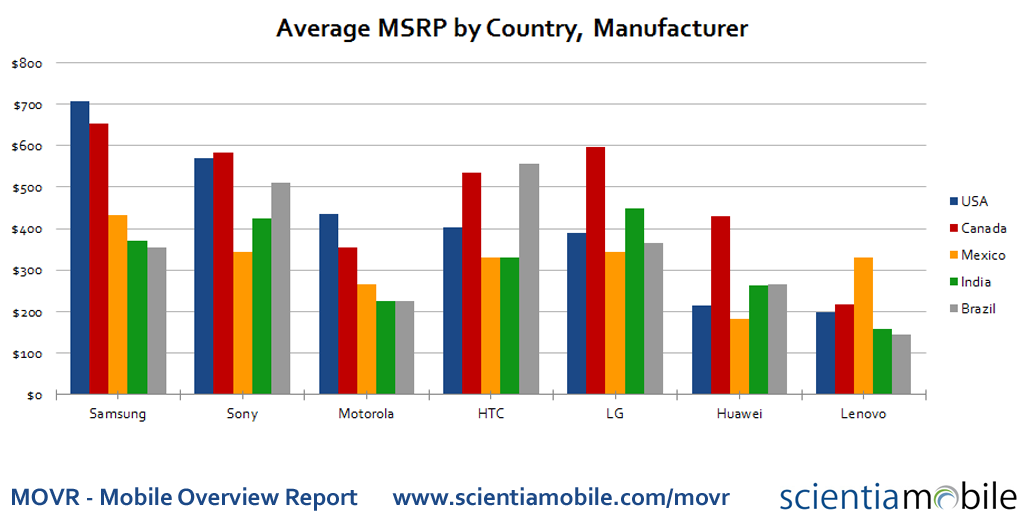

Manufacturers’ Pricing Strategy Varies Across Countries

Manufacturers take pricing sensitivity into account when offering models for different countries. Samsung offers a range of models, with lower priced variants (e.g. Samsung J3) appearing more frequently in countries with lower gross income (e.g. India, Brazil). Motorola follows a pricing strategy similar to Samsung, but at a consistently lower MSRP. Huawei follows a different strategy. They consistently offer low priced devices, regardless of the country’s GNI. Canada appears to be an exception.

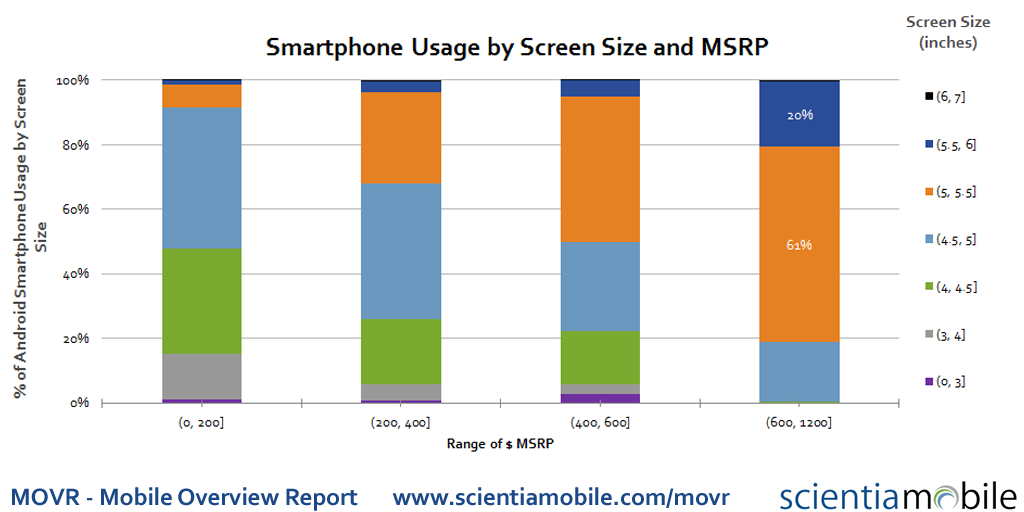

Screen Size Drives Higher Price for Smartphones

Does a larger screen mean a higher price for the smartphone? The answer appears to be, “Yes.”

While there are large-screen phones (more than 5 inches) at all prices, they are more frequently priced higher. And in that premium-price range (over $600), over 80% of traffic is generated by screens over 5 inches.

Contact us to find out how WURFL can improve your Ad Tech and Market Tech platforms